Are you struggling with managing your student loan and need a fresh start? As a Louisville, Kentucky, student loan lawyer, I handle many student loan collection defenses and lawsuits. Additionally, I have taught other lawyers with Morgan King, co-authored a book about it, and graduated from training for it with Josh Cohen. I often file bankruptcy cases to stop student loan garnishments, bank account garnishments, or discharge the student loan debt when paying is an undue hardship for my clients. When I’m your student loan lawyer, I give you a complete analysis of how to manage your student loan debt on our website and with in-person appointments.

Student Loan Collection Defense Lawyer

Successful Student Loan Bankruptcy Discharge

The bankruptcy code tries to make student loan debt non-dischargeable. Nonetheless, approximately 500 undue hardship case filings grant undue hardship discharges student loans every year. About 500 cases are successful every year in getting one of the hardest discharges possible, known as the “undue hardship student loan discharge.” Four studies have been made, and all agree that without an attorney and without money to file the case, people can often do this themselves. It is often done without an attorney because attorneys believe they can’t do it. They also may not know how or may not want to do the work, or perhaps it does not pay enough.

Iuliano, in his study, found debtors obtained complete discharges 39% of the time. Pardo and Lacey found that 57% of the time, debtors got a partial or complete discharge. Bayuk is the third older study, but more recent law articles and studies are available. Ryan Freeman at Emory did an empirical study. Richard B. Keeton wrote how Brunner has evolved into newer and better tests to prove undue hardship.

Successful Income-Driven Plans

The fact is that almost everyone can make their government student loans affordable with a proper income-driven repayment plan. The problem is that the servicer’s profits are often linked to how high the student loan payments are. The higher the student loan payments, the more the servicer or debt collector profits. One tactic government servicers use is to place accounts into deferment or forbearance when the student debtor is unemployed. The payments should be zero if the debtor has no income. By placing the account in deferment the servicer increases the debt instead of paying down the debt.

This article explains some of the solutions that make most student loans affordable. Getting a fair loan becomes difficult or impossible unless you know how to manage the debt and what the servicers and student loan debt collectors do. Our office and student loanify can compare the different programs.

Just read the article Student loan reform: Rights under the law, incentives under contract and mission failure under ED. The servicer or debt collector you trust and deal with often is interested in charging you the most he can get from you and is not interested in helping you.

The Student Loan Collection Defense Lawyer Checklist

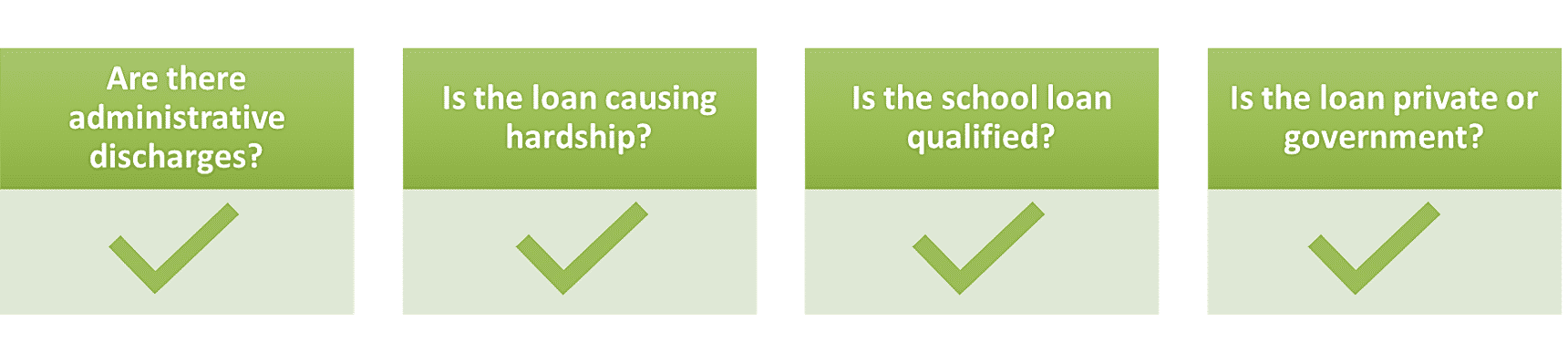

This is a checklist of questions to qualify for programs to discharge your loan. For instance, your loan may be dischargeable in bankruptcy if:

- The school does not qualify as an approved secondary school,

- Or if you did not qualify as a student,

- The course is not qualified,

- Or the loan was for more than the cost of attendance.

- The tax code section defines these elements in 26 USC 221(d)(1).

Private student loan debt must sue to collect. They have little or no income-based repayment plans to make them affordable, so they are far more likely to be discharged as an undue hardship. The private school loan holder is often less likely to object to an undue hardship discharge if you also sue the lender or school in a counterclaim. If the private student loan payments have no affordable option and prove undue hardship, it becomes dischargeable in the bankruptcy process.

Your Student Loan Debt Options

Government loans have several repayment options. You often have methods to make loans affordable or avoid a monthly payment. For instance, if a student loan debt attempts to garnish wages or social security, you can file a Chapter 13 with a minor monthly payment and stop collections. If the student loan debt is a private loan and the case did not obtain a judgment, the litigation stops and eventually gets dismissed. The debt holder is unlikely to file a second case to collect the private loan.

If the government loan is a hardship even with income-dependent terms, an undue hardship discharge in the bankruptcy process is possible if it is still an undue hardship. Often filing the adversary proceeding will accelerate any pending application for an affordable option. Finally, there are also Administrative discharges for disability, cosigner’s death, closed schools, and other events.

Some Expenses Make Student Loans Dischargeable

Some Expenses Make Student Loans Dischargeable

To be dischargeable, the loan must be a “qualified educational debt” as defined by 11 USC 523(a)(8)(B) and 26 USC 221(d)(1). To be a “qualified higher education debt,” the expenses, cost of attendance, eligible educational institution status, course of instruction, and the student must all be eligible under these definitions. These limits on school loans are defined and hidden in the IRS code and section §472 of the Higher Education Act of 1965 (20 USC 1087ll). You would think the bankruptcy code would define all the requirements for the undue hardship. However, most student loan sections are not in the bankruptcy code.

- Only debts made to “eligible” students are non-dischargeable in bankruptcy relief. If you were not qualified to attend a college, the loan is dischargeable.

- Only qualified higher educational expenses are non-dischargeable. The debt must be “incurred solely to pay qualified higher-education expenses” under 26 USC 221(d)(1) and 11 USC 523(a)(8)(B). Loans that mix school and paying other debts like credit card debt or improvements are not eligible under 26 CFR 1.221-1(e)(4). Private schools will often offer loans for more than the cost of attendance. This makes the loan dischargeable. Also, debts directly to the school are dischargeable, such as bills from a school for housing and even tuition.

- Only loans made for attendance at qualified schools by qualified students under 26 USC 221(d)(1)(C) and USC 523(a)(8)(B) are generally not dischargeable.

Loans for Some Schools Do Not Qualify and are Dischargeable

First, only attendance at an accredited educational institution is non-dischargeable. Your loan is dischargeable in bankruptcy court if you attended an unaccredited school. Harvard is an accredited school. Bill’s school of scuba diving, sky diving, flight instruction, or truck driving isn’t. Accredited schools are Title IV institutions, and a qualified education loan is “indebtedness incurred by the taxpayer solely to pay for qualified higher education expenses.” 26 USC 221(d)(1).

If your school is not listed, it is probably not an accredited and qualified school. Also, if you could not benefit from the school program, you may be able to discharge the debt. Individuals who were never able to graduate high school or obtain a GED are examples of persons who could not benefit from a college course.

Veteran Student Loans are Dischargeable in Filing Bankruptcy

Veteran Student Loans are Dischargeable in Filing Bankruptcy

Second, some loans have separate statutes that allow a discharge. For instance, VA student loans are dischargeable after five years 38 USC 303 a(e)(4). The Department of Defense also issues loans that are dischargeable after five years under 20 USC 6674(f)(3). The Troops to Teachers program bars any discharge, even if it is an undue hardship to the debtor. Heal loans use an unconscionable standard which is harder than the undue hardship standard.

The Undue Hardship Standard for Bankruptcy Discharge

Third, student loans are dischargeable if payment would be an undue hardship for the student or his dependents. If you can’t afford food, shelter, or medical care, the loan is probably an undue hardship. Private loans are easier to discharge under this standard because they have no income-based repayment period plans to make private loans affordable. Under the Brunner test, the student loan is dischargeable in bankruptcy if:

- The debtor cannot repay and maintain a minimal standard of living.

- The situation will continue for a significant portion of the repayment period.

- The debtor has made reasonable faith efforts to repay.

Undue hardship discharges for government loans require that the Debtor has done all he could to repay an income-based repayment before filing an adversary case for undue hardship in bankruptcy court. Obtaining an undue hardship is one of the hardest things a student loan lawyer can attempt, but it is not impossible. The Brunner standard is becoming more and more unpopular, and it is becoming more and more popular to look at the debtor’s future than a past monthly payment. Courts including the circuit which created the Brunner test use “Overall circumstances” and the “Anderson tests”. Every year there is proposed legislation to allow more student loan discharges.

Which Bankruptcy Chapter Should I File to Manage or Discharge Student Loans in Bankruptcy

File Bankruptcy Chapter 7 and Student Loans

If you file bankruptcy using a Chapter 7, the case is usually over within 4 months. During those 4 months, income tax collection and student loans are not allowed to be collected due to a temporary court order called a stay. The stay only lasts while the case is open, and collections can and often will return to normal. At the end of the case, you usually obtain the discharge, and non-dischargeable debts may again be collected, but discharged debts may not be collected.

If you want to discharge your student loans, you must file an adversary proceeding. In your adversary proceeding complaint, you have to allege and attach proof that collecting this debt would be an undue hardship, not just a hardship. Undue hardship is often seen as a hardship where you or your dependents (children or spouse) would have to live without food, medical care, or housing. The debtor has to show they are using their best efforts, but the situation is close to hopeless.

Reopening the Undue Hardship Adversary Case in Filing Bankruptcy Chapter 7

A Chapter 7 bankruptcy is often the correct Chapter for the debtor to file if the debtor is seeking a discharge of government student loans. Government student loans are often income-dependent, and because the loans are adjustable, they are almost always affordable. The major problem is often the unwillingness of the servicer to adjust the payment low enough to make it affordable. With a judge reviewing the math and whether the servicer correctly calculated the loan, the servicer will almost always go back and lower the payment to make it affordable. This may only be temporary for a couple of years. Still, the debtor can return to court years later and open this adversary proceeding to make a finding that the student loan is dischargeable later.

Chapter 13 Bankruptcy and Student Loans

Why repay creditors in Chapter 13? Essentially that is what you are doing if you file a Chapter 13. You may be admitting that your student loan debt is not such an undue hardship and you can afford to repay something.

Under those admissions, government student loans are not dischargeable because if they can lower their payment to 175 per month or less, the student loans replace your Chapter 13 plan payment when you finish the Chapter 13 case.

We have already hinted at why Chapter 13 is an excellent tool for getting rid of private student loans. First, once private student loans become over 6 years old, they become past the statute of limitations for Kentucky and become uncollectible. The period of time you are in Chapter 13 however does not count towards running the statute of limitations period. But second, if you file a Chapter 13 and the loans are not repaid for 5 or more years, the private student loan is unlikely to return and sue to collect.

Making the Private Student Loan Uncollectible in Chapter 13

Private student loan lenders essentially have to beg for money or sue to collect. Private student loans cannot garnish wages, bank accounts, or attach homes without suing and attaching property with judgment liens or garnishments. They have first to sue and then obtain the judgment.

Government student loans don’t have to sue to attach wages or bank accounts. If Chapter 13 lasts for 5 years, the state court judge will dismiss his case rather than wait 5 years. Do not pay a private student loan through the plan.

Then after having their state court case thrown out and not being paid for five years, private student loan debt collectors rarely file a second case. As the debt ages, the statute of limitations makes the debt uncollectible. The five years you are in Chapter 13 do not count; however, towards the 6 years, you need not pay or admit you owe the debt.

Qualifying your Loan for Administrative Discharges

Fourth, the loan might qualify for an administrative discharge or another program. The nice part is that many administrative discharges or rehabilitations are simple, short forms. Interestingly, our office and Salt have listed over 60 programs that repay loans or help repay loans. For your further information, the following are just some of the more popular administrative discharges found on StudentAid.Gov:

- Death

- Stolen Identity

- Closed School

- Unauthorized Signature

- Public Service

- Disqualified Status

- Disability

- Unpaid Refund

- Inability to benefit

- Unaccredited school

- Public Service

- Teacher Service

- Perkins Cancellation

- Borrower Defense to Repayment School failure to perform

- False Certification

Private vs. Government Student Loan Collections

Fifth, government student loans can seize wages, bank funds, tax refunds, and social security benefits without going to court. Private lenders have to sue and win to collect. That may be hard or impossible for private loans. Private student loans have higher interest rates, rely on cosigners, and have no income-based repayment period programs. This makes private student loans more likely to be an undue hardship and easier to discharge.

Also, many of the same defenses you make against a credit card debt, such as the statute of limitations, are valid against private student loans. However, government student loans are exempt from many of the same defenses. You need a student loan attorney who knows how to handle these cases.

Private student loan debt, transfers by selling and reselling. If it is, it may be uncollectible. There are at least 100 defenses to any lawsuit by a private student loan debt collector, including the statute of limitations. We commonly look at about 63. Private student loans must sue to collect. The common defenses include:

- Statute of Limitations

- Lack of Standing

- Fraud

- FDCPA, TILA

- Identity theft

- Evidence

- Business Records

- Jurisdiction

- Laches

- Improper Venue

Your Louisville, Kentucky Student Loan Collection Defense Lawyer!

This is just a partial list of some items to consider if you have student loan debt issues. If you are suffering from an abusive situation with a student loan, contact my office to have a detailed conversation with an experienced student loan lawyer right away- Nick C. Thompson, Bankruptcy Attorney: 502-625-0905

Resources for Bankruptcy

Resources for Bankruptcy

Student Loans in Chapter 13 Bankruptcy

Bankrupt or Discharge Student Loans in Bankruptcy

Veteran Student Loans are Dischargeable in Filing Bankruptcy

Veteran Student Loans are Dischargeable in Filing Bankruptcy